Search here

Can't find what you are looking for?

Feel free to get in touch with us for more information about our products and services.

Finding the right retail locations is a lot like navigating a city without street signs – you might eventually reach your destination, but not without wasted time, missed turns, and lost opportunities.

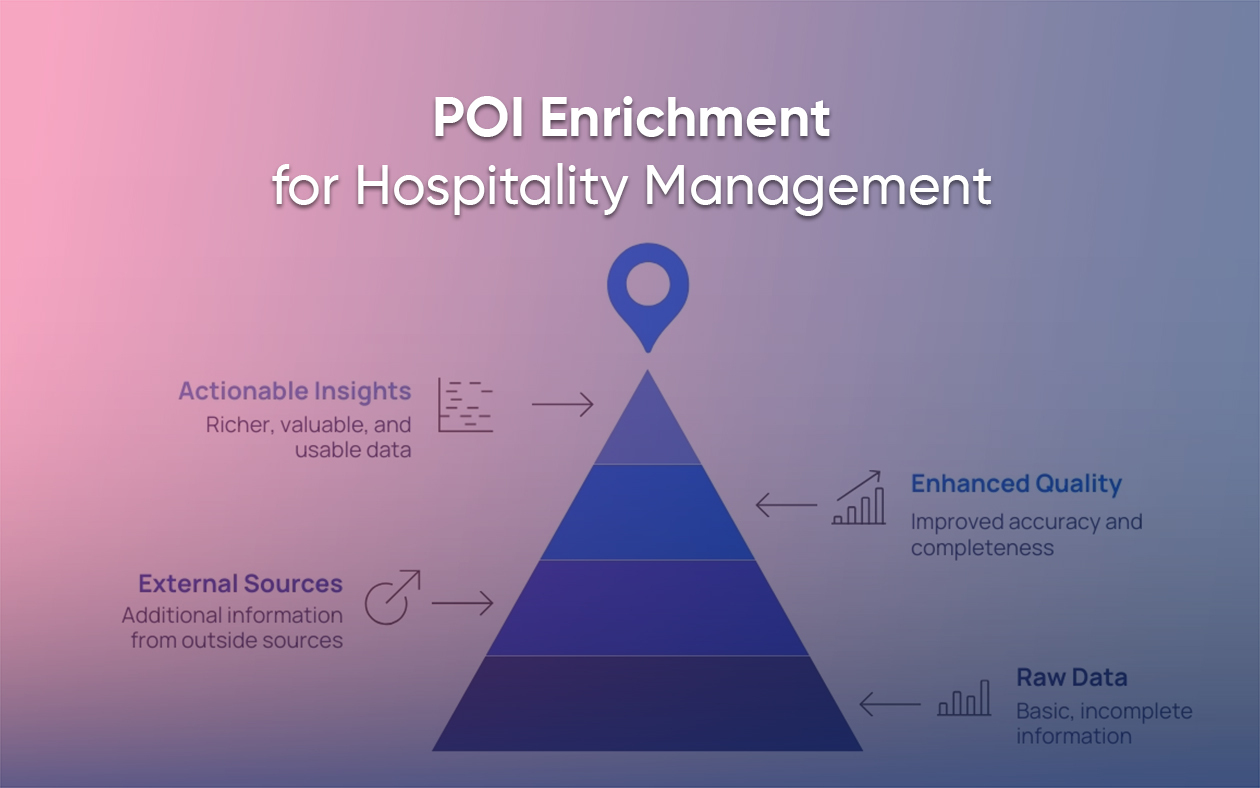

Points of Interest (POI) data acts as those street signs, offering clear visibility into where consumers shop, dine, and gather. For global brands in competitive markets, having access to accurate, hyperlocal POI data is the difference between strategic clarity and blind decision-making.

Recently, Grepsr partnered on a project to deliver high-volume POI datasets across cities globally. We helped a consulting team discover granular retail coverage for their major FMCG client.

With a three-week deadline, Grepsr’s challenge was to capture comprehensive data at scale while ensuring accuracy, speed, and strategic alignment. Let’s dive into the details.

TL;DR

A global consulting firm needed large-scale POI datasets across major cities to support an FMCG client’s frozen foods distribution strategy.

- Requirements: Granular coverage across multiple retail categories, alignment with internal datasets, and a strict 3-week turnaround.

- Problems: Search result caps, duplicates masking unique outlets, fluctuating extraction speeds, and heavy infrastructure demands in sprawling metros.

- Challenges: Meeting tight deadlines, adapting to Google SERP changes, scaling infra (proxies from 250 → 1,700, pods from 5k → 14k), and managing expectations when projected volumes plateaued at the actual validated records.

- Solutions: Dense grid search for deeper coverage, infra scale-up to ensure speed, adaptive engineering for changing SERPs, daily dashboards for visibility, and transparent expectation management.

- Impact: Delivered benchmark-ready POI data on time with hyperlocal granularity across global cities, giving the client faster insights, financial clarity, and stronger credibility with their FMCG partner.

About the client

A leading global consulting firm wanted to map and analyze retail points of interest (POIs) across major cities. The goal was to benchmark retail coverage, evaluate distribution channels, and design data-driven strategies to strengthen their client’s frozen food business.

Their requirements

The consulting firm required a comprehensive dataset of POIs spanning multiple categories, including:

- Modern trade and grocery outlets

- Hotels, restaurants, and cafés (HORECA)

- Chemists and pharmacies

- Petrol stations and other service-based businesses

Their priorities were clear:

- Granularity and accuracy: Capture both dense and dispersed retail clusters.

- Benchmarking capability: Align third-party data with internal datasets already available from FMCG partners.

- Fast turnaround: Delivery within a strict three-week deadline to meet their own project commitments.

The problems

Even in the world’s largest cities, getting a complete picture of retail landscapes isn’t straightforward:

1. Search limits

Digital platforms like Google Maps cap search results and paginate listings, which often exclude thousands of POIs across dense urban centers like Tokyo or São Paulo. Without workarounds, entire neighborhoods risk being left unaccounted for.

2. Duplication vs. uniqueness

Popular outlets in areas like London’s West End or New York’s Midtown dominate top results, while niche but strategically important outlets get buried. For market analysis, that imbalance creates blind spots.

3. Unpredictable extraction speeds

With millions of POIs spread across global cities, fluctuating extraction rates create uncertainty about whether massive datasets can be delivered within weeks rather than months.

4. Infrastructure strain

Cities like Delhi or Mexico City, with sprawling retail networks, require query volumes far beyond normal infrastructure capacity. Scaling up to meet these demands meant the project quickly started to push beyond estimated bandwidth and costs. Without robust scaling, there was a high risk of bottlenecks and delays.

The challenges during execution

The problems stated above already set the stage for why POI data was so hard to collect in the first place. But that’s not all. We further dealt with major challenges that made this project difficult to execute despite having a solution in mind.

Delivering comprehensive POI datasets across major global cities brought together a mix of operational, technical, infrastructure, and commercial hurdles:

1. Operational pressure

The consulting partner had already committed strict deadlines to their FMCG client. This meant there was zero buffer for delays. Daily visibility into progress was a necessity, and follow-ups became increasingly intense. The challenge was balancing transparency and speed without letting communication overhead slow delivery.

2. Technical barriers in data extraction

Search result limits on platforms like Google Maps capped the number of POIs that could be retrieved per query. In dense hubs like New York, London, or Singapore, this meant thousands of stores risked being missed. On the other hand, duplicate results dominated top pages, while unique niche outlets that were strategically important for FMCG expansion remained hidden.

3. Infrastructure scaling across cities

To cover cities with sprawling urban footprints (from São Paulo to Delhi to Los Angeles), the volume of queries required far exceeded normal pipelines. Without significant scaling of proxies, servers, data pods, and manpower, there was a real risk of system bottlenecks, blocked requests, and inconsistent extraction speeds.

4. Platform-level constraints

Continuous changes in Google’s search result pagination (shrinking from hundreds of results per keyword to just a fraction) meant the data extraction logic had to be adapted on the fly. This created additional resource demand on infrastructure, further increasing costs and making it more complex and expensive to deliver consistent POI data city by city.

The solutions

The project came with significant bottlenecks and an unyielding deadline, but failing wasn’t an option — the client’s market intelligence depended on timely, accurate delivery.

By reengineering workflows, automating key extraction processes, and scaling our quality checks, Grepsr not only overcame the hurdles but ensured the client received a dataset they could immediately put into action.

A. Overcoming search limits & coverage gaps

To bypass platform-imposed caps and pagination limits, Grepsr implemented a dense grid-based search strategy. Instead of using broad 1 km grids, we shifted to 0.2 km grids across city boundaries, multiplying the number of lat/long points by over 2000%. This ensured that even in dense metros like New York, London, or Singapore, smaller clusters of outlets were captured, delivering a dataset with far deeper retail coverage.

B. Capturing unique POIs, not just duplicates

By increasing the search density and optimizing query distribution, Grepsr was able to surface hidden, less-prominent POIs that would otherwise remain buried under popular listings. This gave the consulting partner a balanced dataset that reflected not only major chains but also the unique, local outlets critical for FMCG distribution strategy.

C. Scaling infrastructure at enterprise speed

To handle the surge in data requests across global cities, Grepsr scaled its platform aggressively:

- Proxies: Expanded from ~250 to 1,700 i.e., 580% increase.

- Servers/Pods: Increased from 5,000 to 14,000 or 2.8X pods allocated just for this project.

- Caching: Optimized I/O latency from 90ms to single-digit milliseconds, reducing cost while drastically improving throughput.

These measures guaranteed that delivery timelines were met despite exponential query volumes.

D. Adaptive engineering for changing SERPs

When search result pagination shrank mid-project (from 20 pages down to 6), Grepsr quickly adjusted its extraction logic to capture results deeper in the listings. This proactive adaptation ensured the client still received comprehensive coverage, even as platform constraints evolved.

E. Transparent progress

A real-time progress tracker was shared with the consulting team, showing daily extraction rates mapped against geographic coverage. This visibility gave the client confidence to keep their FMCG partner updated while reducing pressure on the delivery cycle. Clear communication boundaries also ensured scope alignment while still maintaining urgency.

F. Commercial alignment and expectation handling

High-volume extractions across large metros like São Paulo revealed a gap between initial expectations and the actual market reality. For example, the client anticipated 250,000 POI records, but even after multiple re-runs, the true count plateaued at ~150,000. This was the factual, validated number available.

Instead of overpromising, Grepsr focused on transparency and expectation alignment:

- Reality-based delivery: Reported actual validated counts rather than chasing unrealistic projections.

- Predictable pricing: Maintained a flat-rate model to ensure cost clarity despite higher infrastructure usage.

- Expectation management: Helped the client adjust their internal planning and narrative with data-driven facts rather than assumptions.

- Scalability for future projects: Continued to structure pricing around geographic coverage to handle similar cases across other global metros.

This approach underscored Grepsr’s role not just as a data provider, but as a partner in managing expectations as well.

The final outcome

By the end of our partnership, the consulting firm had in hand a high-density, validated POI dataset covering major global cities — one that went beyond the limits of standard search platforms and provided a uniquely granular view of the retail landscape.

- On-time delivery – Completed within the 3-week deadline, enabling the client to meet its FMCG commitments.

- Benchmark-ready data – Comprehensive dataset aligned with internal data for stronger, credible insights.

- Granularity at scale – Hyperlocal coverage across major metros, capturing both chains and smaller outlets.

- Operational confidence – Proven ability to scale infrastructure for complex, large-city projects.

- Financial predictability – Flat-rate, area-based pricing removed cost uncertainty.

- Competitive edge – Faster, cleaner data gave the client deeper insights and stronger positioning.

Ready to uncover hidden opportunities in the world’s most competitive markets?

Grepsr delivers high-density, accurate POI data at a global scale, helping consulting firms, enterprises, and brands move faster, plan smarter, and outpace the competition.

Talk to us today and see how Grepsr can power your next location intelligence project and fuel data-driven strategies!