Search here

Can't find what you are looking for?

Feel free to get in touch with us for more information about our products and services.

Leveraging one of Grepsr’s job postings data projects to gather insights — the hottest industries and employers, including working conditions

The US economy was forecast to spiral into a recession in 2023. Yet, despite fears, if current job listings and hiring trends are to be believed, the current economic reality appears to be quite different. The robust nature of the current US job market is proving to be one of the main drivers of the country’s strong economy.

CNN reports that hiring increased unexpectedly in May. More jobs were added to the economy than any single month in 2019. Thus, it was one of the strongest years for the job market.

As such, we thought it would be relevant to analyze one of Grepsr’s jobs data extraction projects and gather a few insights.

Dataset overview

Our sample dataset contains almost 800,000 US-based job postings from the jobs platform Indeed. These data are in the time range of January 2023 to mid-April 2023. The data includes open positions from hundreds of industries and thousands of employers across the country.

Data analysis

Disclaimer: All analyses presented here are based on a sample dataset from one of our data extraction projects. Hence, they do not reflect the entire market. This is only a hypothetical use-case of potential insights that could be gathered for better decision-making.

Job postings correspond to economy

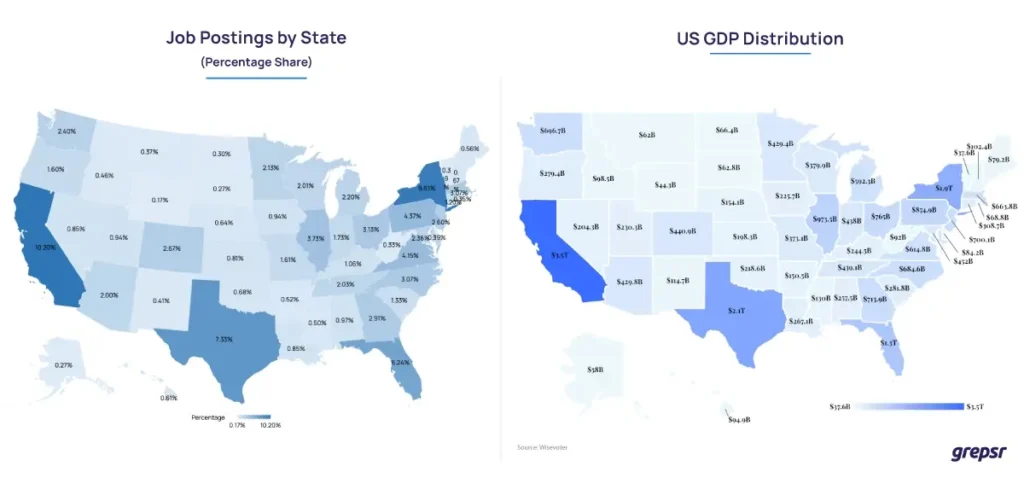

Since our dataset contains job postings for US-based companies, we first looked at the state-wise distribution.

Job openings are indicative of the economy, and we do actually see a similar representation. As shown in the graphic, the state-wise job posting chart is in line with the country’s GDP distribution.

As with the GDP, California leads the way in our sample data with 10.20% of the overall job listings (80,483 records). Sequentially, New York (9.61%), Texas (7.33%), Florida (6.24%), and Pennsylvania (4.37%) complete the top five.

Related read:

Most in-demand industries and job categories

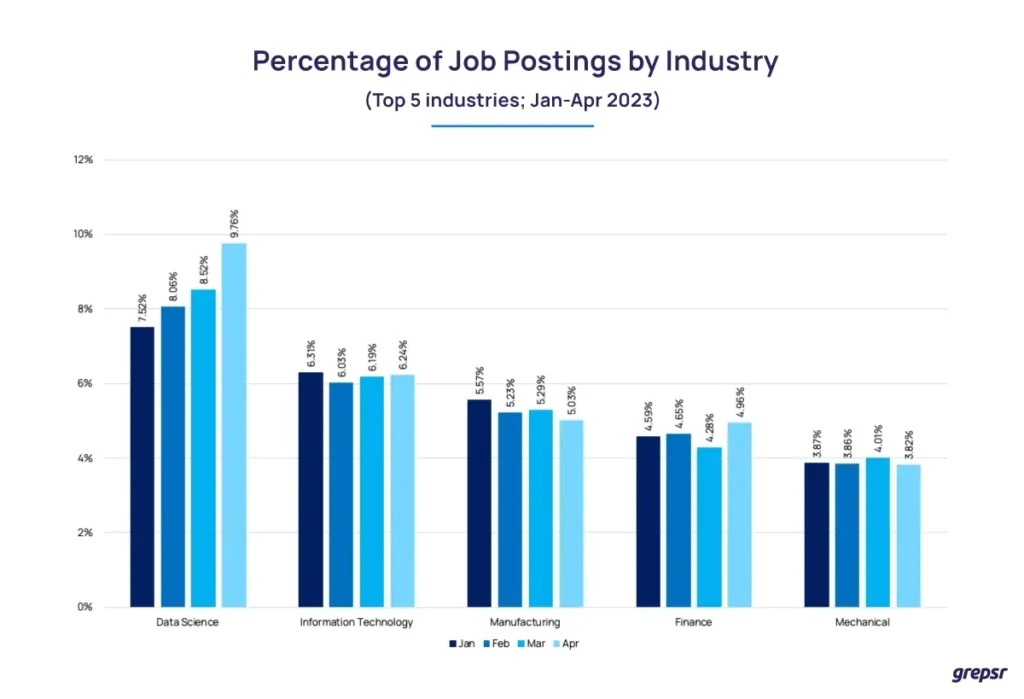

With data and technology at the forefront of today’s world, it is no surprise that, even in our sample dataset, we see data science and IT as the top industries in terms of new job listings.

We see an upward trend for data science positions. The graph portrays a rise from 7.52% of all job postings in January to 9.76% in April. In comparison, information technology jobs account for roughly 6% throughout the same period.

The data for other industries among the top 5 also represent fairly consistent percentage shares from January to April.

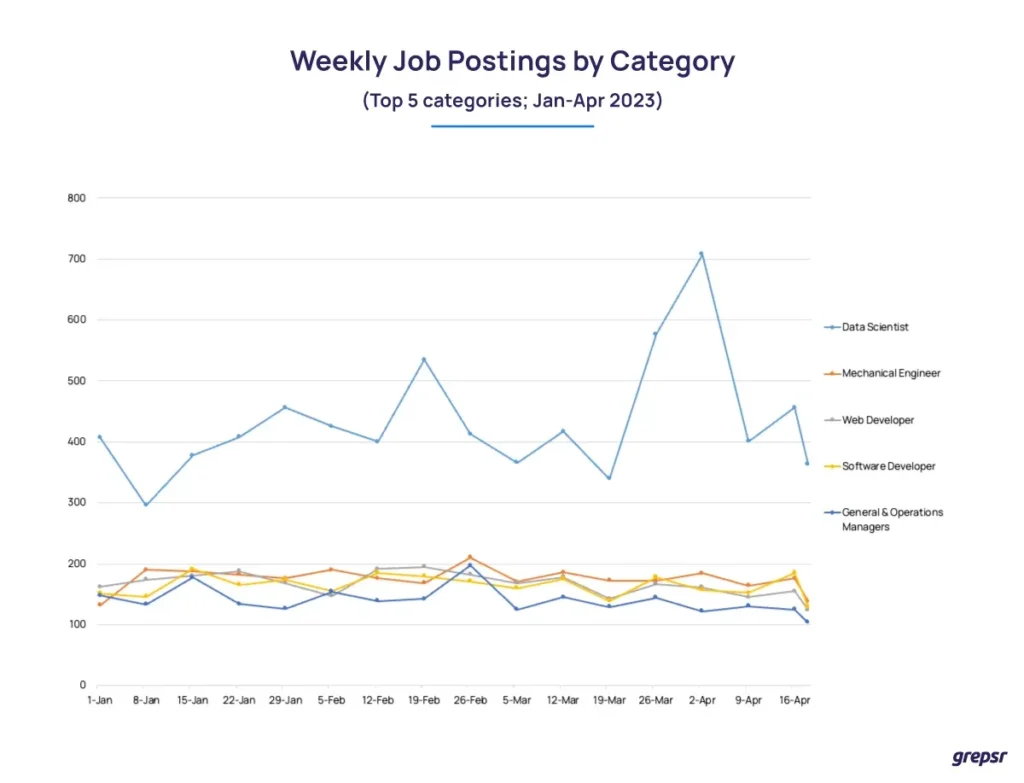

Similarly, as more businesses transition towards being more reliant on data analytics and insights for decision-making, data scientist is now the most sought position in the job market. Consequently, the top categories in our sample dataset are also hogged by data and tech positions.

Full-time vs part-time

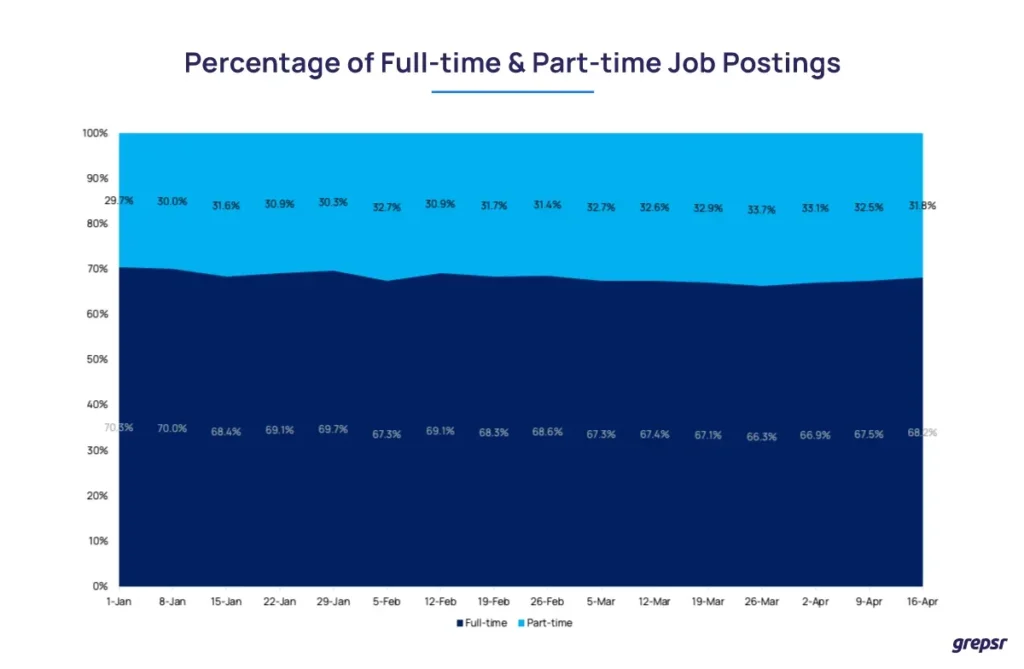

Next, we analyze the data for full-time and part-time positions.

What we notice is that throughout our time range of January to mid-April, consistently two-thirds of the overall positions are full-time.

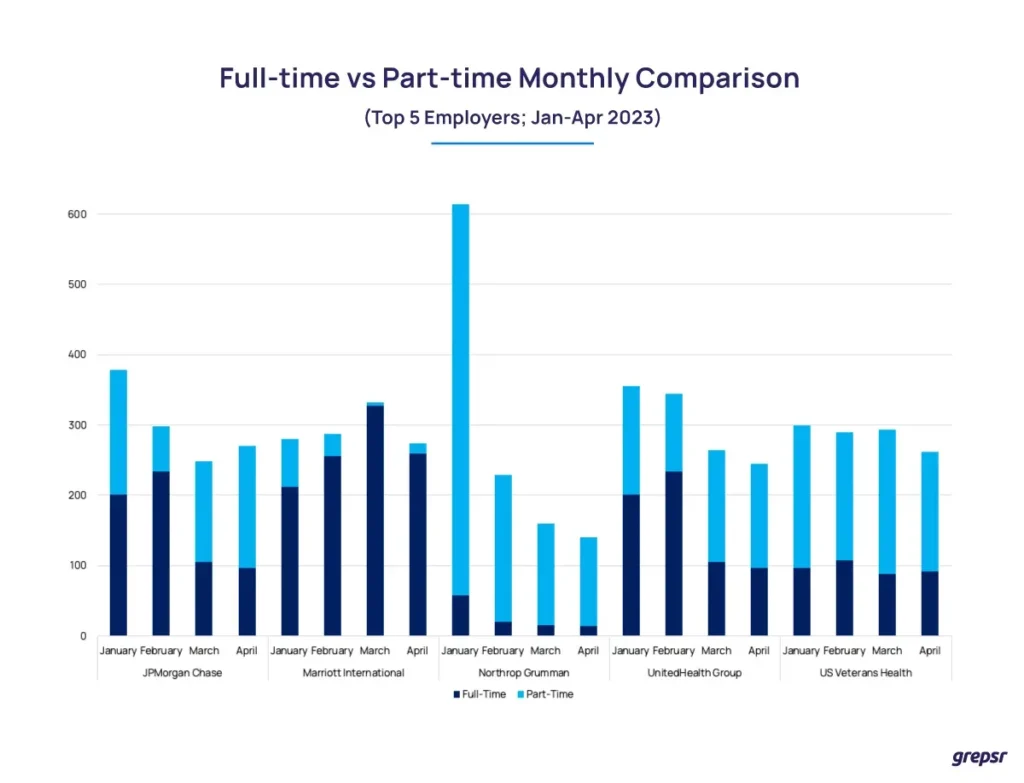

Top 5 employers

In our sample data, between January and mid-April 2023, UnitedHealth Group listed the most job openings with 1,210 records. It is followed by JPMorgan Chase (1,210), Marriott International (1,173), US Veterans Health (1,146) and Northrop Grumman (1,143).

Contrary to our previously-observed average ratio of 70:30 for full-time to part-time jobs, the same ratio varies quite significantly within the top 5 employers.

While JPMorgan Chase has on average 50% of their listed jobs full-time, more than 90% of Marriott International’s jobs are full-time.

On the other hand, Northrop Grumman has more than 90% of the job openings listed as part-time. Additionally, they also seem to recruit heavily in January, with 600+ new positions listed for the month.

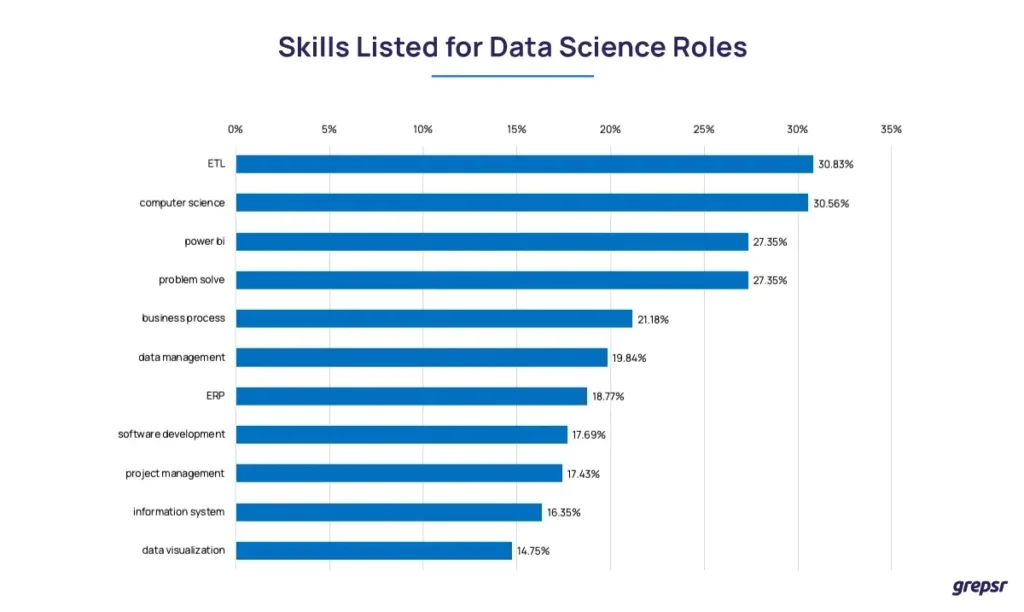

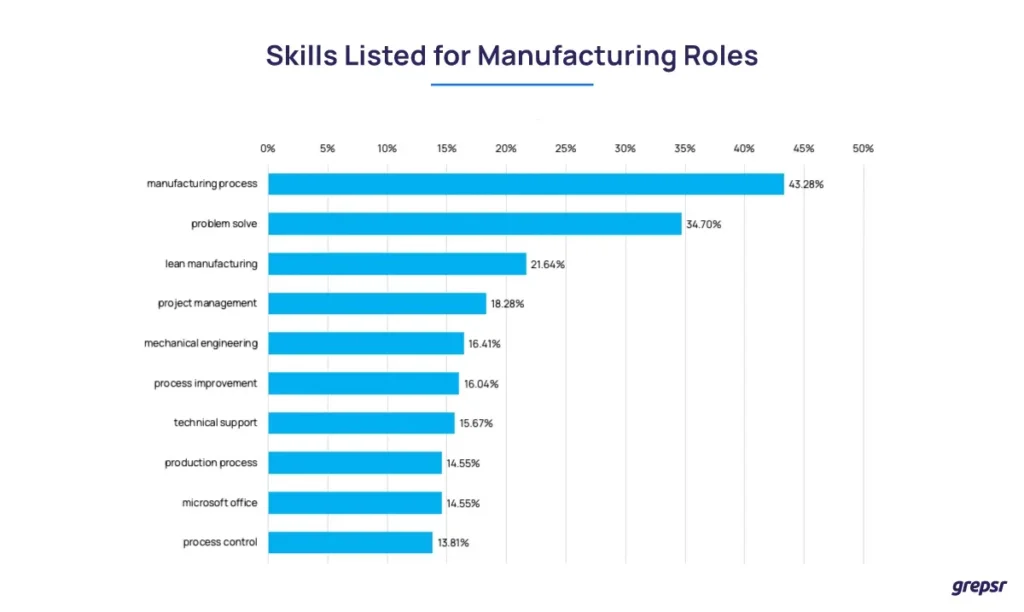

Skill sets comparison for tech vs non-tech positions

Technical and non-technical jobs require vastly different sets of skills. As two of the most in-demand industries, we compared the skills listed for openings in data science and manufacturing.

For data science roles, knowledge of ETL (Extract, Transform, Load) processes and computer science are the two most required skills. Given that, both are in more than 30% of all openings.

In comparison, 43% of manufacturing positions list knowledge of manufacturing processes, making it the most required skill in the industry.

For technical and non-technical roles alike, expertise in Microsoft Office seems to be ubiquitous in any industry.

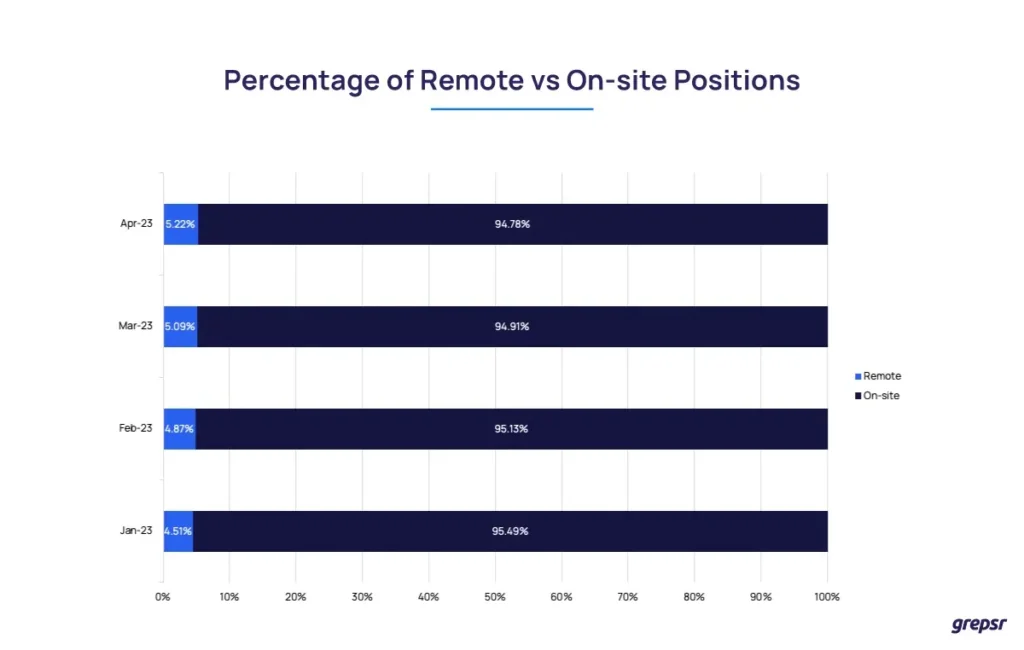

Return to pre-Covid conditions

With the Covid pandemic now officially over, we thought it would be interesting to see what proportion of listed roles still allowed remote working.

In our sample data, we see that every month, only around 5% of positions are remote, with 95% requiring on-site presence. This could suggest that US-based employers are already returning to pre-pandemic working conditions.

Conclusion

The job market data can be one of the main indicators of the economy, offering insights into hiring trends, industry dynamics, and regional variations.

While our dataset is just a sample, and not indicative of the entire job market. Even so, we are still able to extract insights. Like, the most sought-after industries, employers, job positions, etc., with further evaluation of working conditions.

Seasoned analysts and teams can gather much more insightful and actionable conclusions out of the same datasets. Thus, you can leverage them to make better business decisions.

About Grepsr

With more than 10 years of experience, Grepsr has been extracting data from across the job market. Some are Indeed, Glassdoor, Monster.com, Angel List, and more. Whatever the complexity, our seasoned engineers have all the technical nous. We are capable of overcoming all obstacles that are ubiquitous in the data extraction process. Henceforth, let us take over the tedium, and provide quality data at scale. Meanwhile, you take charge of hitting the jackpot.

By now, we hope you know who to call for all your job data needs!