Search here

Can't find what you are looking for?

Feel free to get in touch with us for more information about our products and services.

The irreversible rise of e-commerce has been a similar phenomenon around the world. In 1998, the entirety of the e-commerce market stood at just $5 billion.

During the pandemic, as people were locked indoors, e-commerce boomed, increasing by 43%. In 2020, the number had reached $815.5 billion.

The biggest competition to Amazon is not another online store, but retailers who operate brick-and-mortar stores. No surprise there. The global ecommerce sales growth is on the trajectory of cutting into retail revenue every year from 2023 to 2027.

Hence, a spirited competition ensues between retailers of various shapes and sizes on popular e-commerce platforms.

Evaluating and gauging your portion of the digital footprint grows notably important in a situation like this. Where the ground beneath your feet can give away without a moment’s notice.

Web scraping can be an indispensable arsenal in your repertoire. By efficiently extracting data, and studying it in a digestible format, you can accurately measure your performance and attune your e-commerce strategy.

1. Product Details Page (PDP) Data

The charm of Product Details Page Data lies in its perpetual ability to relay product info and reinforce Unique Selling Points (USPs) to potential buyers non-stop.

You can find comprehensive details, visuals, and feedback online, which is available 24/7. Its informative nature empowers shoppers, while consistent messaging builds brand trust.

Optimized for SEO, it boosts discovery, and personalization tailors the experience. It’s a feedback hub and enables cross-selling. In essence, this data-rich page tirelessly amplifies your product’s value to a global audience.

But the competition on e-commerce websites like Amazon, Walmart, and eBay remains fierce. Rest assured that your competition is looking at what you are selling, and the way you are showcasing your products.

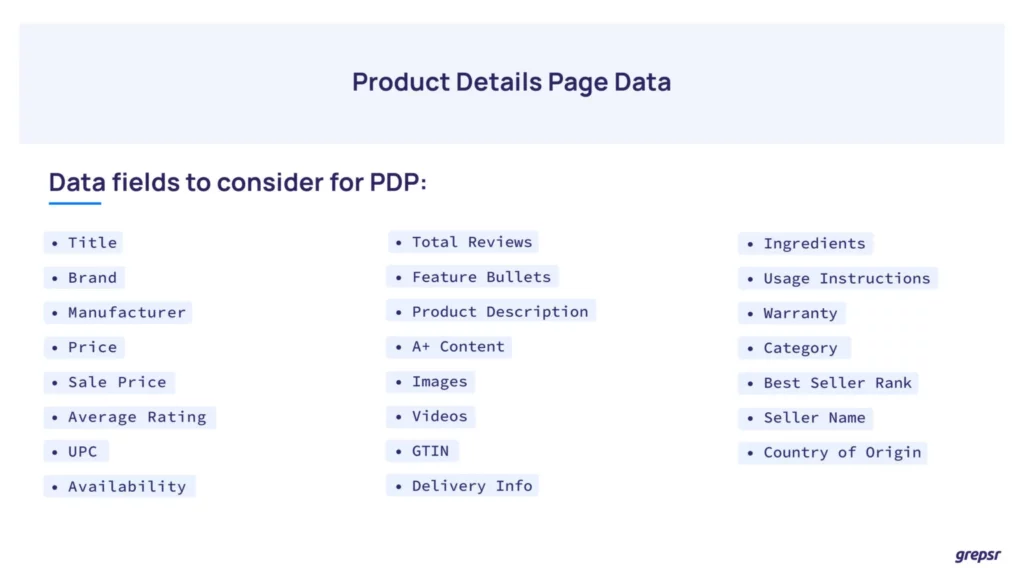

The use case here starts with the identification of a simple web scraping requirement, i.e. the main attributes of a Product Detail Page, which includes the title, brand information, and price.

Put simply, by extracting Amazon’s product details page of your competitors, you can obtain a dataset of title, product description, and specific keywords they may be using to get ahead. This information is worth assimilating into your own product descriptions to rank better and boost profits.

For a more thorough analysis, you can even go further into the data extraction project to scrape virtually all attributes of a product from the site. Armed with this data, businesses go on to audit their product catalog to match the competitors move stride for stride.

2. Pricing Data

It is a subset of Product Details Page data but we believe it is apt to have a separate mention for the data field. Primarily, because of the significance of the pricing dataset within the overall e-commerce dataset.

Consider the difference between Google and Amazon. The former’s principal goal is to provide the best result for a given query whereas the latter focus solely on sales and conversion. In other words, people go to Google to research about a product.

When they make up their minds, they go to Amazon to purchase the product. Meaning, when a user lands on Amazon, they are looking for the best deals. This is where price monitoring comes into play.

Retailers need to stay on top of dynamic prices to offer the best prices to their customers. This has ramifications not only on immediate sales, but also on how well they perform on Amazon’s algorithm.

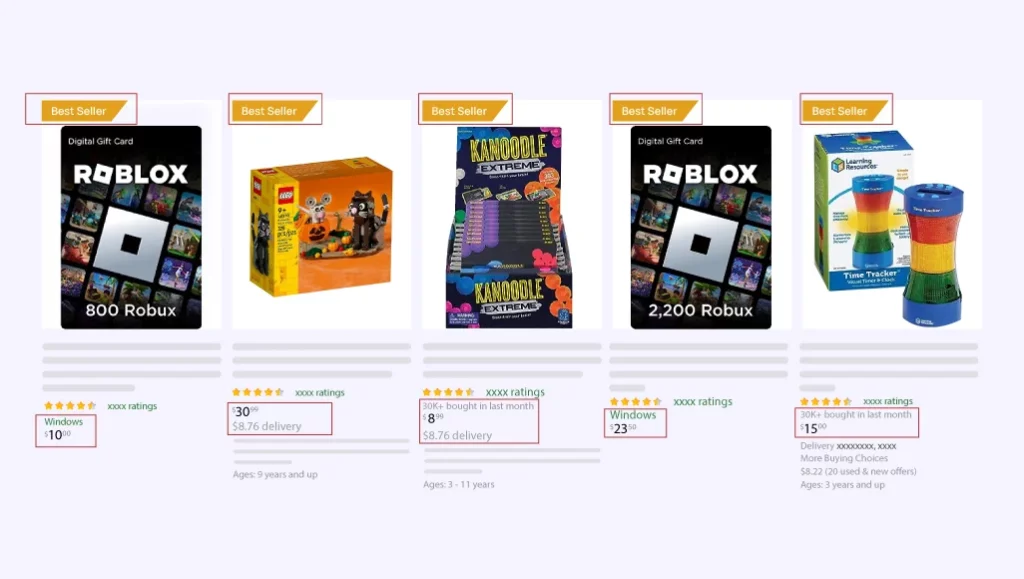

3. SERP listings/Category Page Listings Data

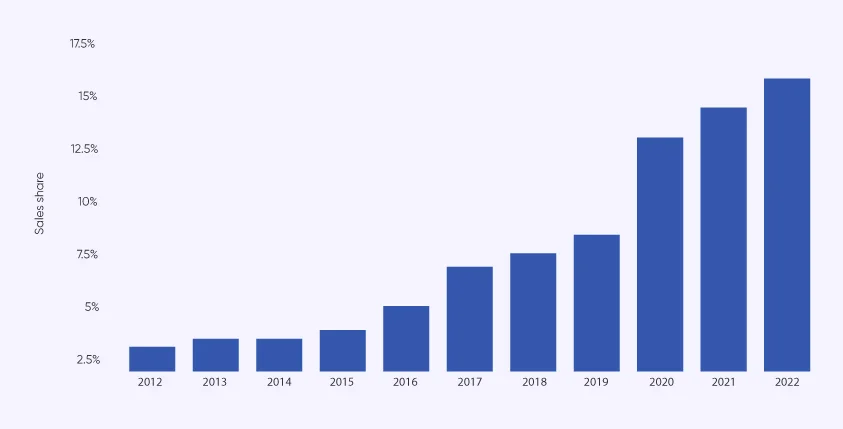

In 2022, e-commerce accounted for 15.8% of Nestlé’s group sales worldwide. This share has been increasing steadily over the past 10 years which shows premier FMCG brands are moving online to boost their profits. While the shift online brings new opportunities with it, there are also pitfalls to watch out for.

The digital realm is contested intensely. So much so that, it is becoming increasingly important for brands to measure their share of voi ce, and benchmark performance against their competitors.

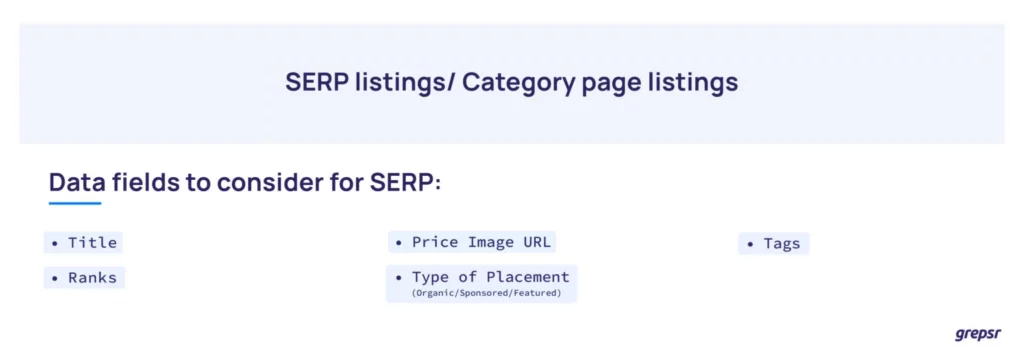

SERP (Search Engine Results Page) listings scraping captures the list of all products available for keywords relevant to your category of products. It includes all sponsored and organic search placement available on the search results page.

With this dataset, you can calculate your share of visibility for every term. Opportunities abound for those willing to dig deeper by scraping category and subcategory listing pages.

4. Customer Reviews/Q&A Data

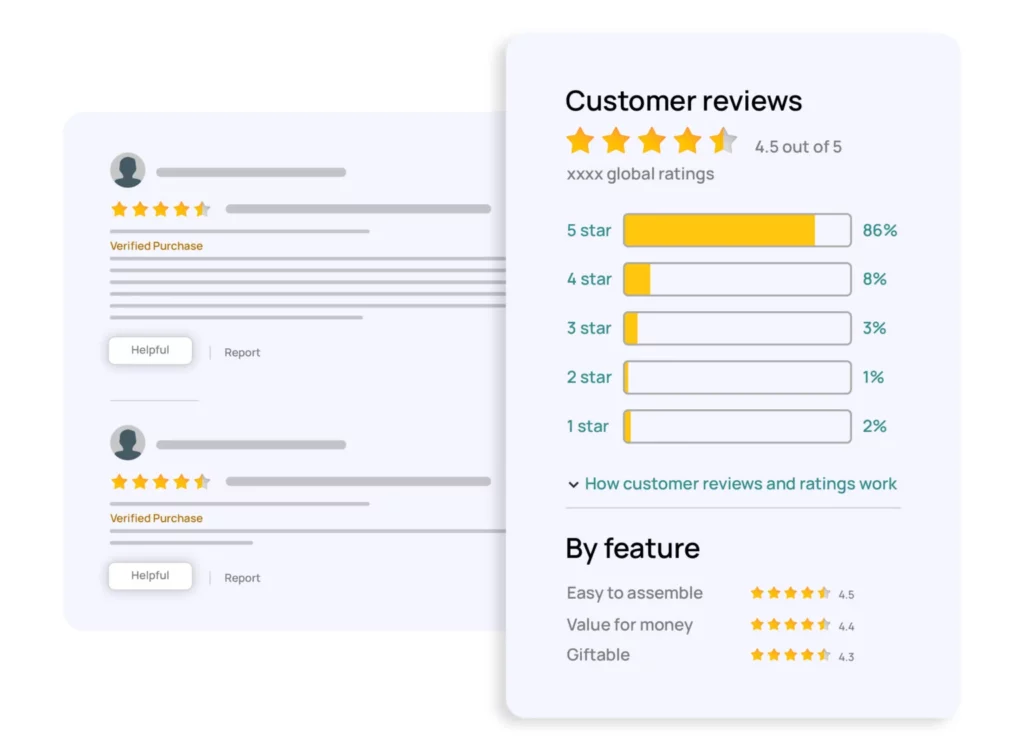

Among other e-commerce datasets, this data has multiple implications for your online presence. First of all, this dataset offers a window into the thoughts and preferences of your customers. Running it through an NLP model enables you to nab specific keywords that are getting traction.

Second, monitoring the customer reviews of your competitors can give you precise information on their weaknesses, allowing you to fine-tune your strategy.

Third, having an abundance of positive reviews improves your search rankings, in turn giving you a greater share of visibility on e-commerce platforms.

At Grepsr, we use web scraping to monitor individual reviews that customers leave for a particular product. Generally, we start with the full list of reviews for the given product and then monitor them regularly (daily or weekly) to pull reviews.

Moreover, we use the same process to extract Q&A data from e-commerce websites like Amazon, eBay, Target, and Walmart.

Here are some benefits of extracting Customer Reviews/Q&A Data:

-

- Determine trends in Reviews and Q&A data to improve content for your existing products.

-

- Analyze Reviews and Q&A data of competing products.

-

- Use Reviews and Q&A data to drive product improvements and innovation.

-

- Monitor questions across multiple product lines to enable swift response from the brand/manufacturer.

5. Buy Box Data

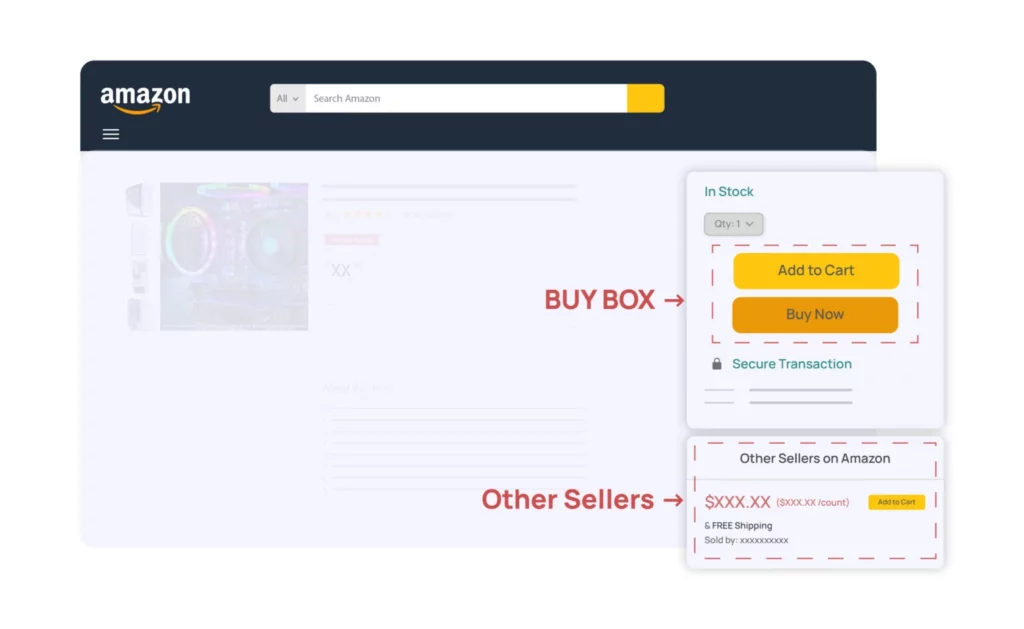

The Buy Box, a small white box typically located on the right side of an Amazon product details page, holds significant importance for sellers. It allows them to distance themselves from competing sellers by enabling customers to easily add items to their cart.

Unsurprisingly, statistics reveal that as much as 90% of Amazon purchases occur through the Buy Box. This dominance is possibly even greater among mobile users due to limited space for displaying “other sellers on Amazon.”

Securing the Buy Box involves a complex interplay of factors, extending beyond mere price reduction. While lowering prices might seem like the solution, it’s far from the only consideration.

Factors like maintaining a consistent inventory flow, ensuring reliable shipping, and achieving high ratings as an Amazon seller collectively enhance the likelihood of Buy Box victory.

Grepsr provides access to datasets pertaining to these pivotal winning factors. But, it’s essential to acquire not only such datasets but also information detailing the frequency of Buy Box wins.

This should encompass both your own successes and those of your competitors. By meticulously studying these datasets, discernible patterns can potentially be unveiled, shedding light on the intricate elements contributing to Buy Box triumph.

6. Minimum Advertised Price (MAP) Data

Minimum Advertised Price (MAP), the lowest figure a product can be showcased at by a retailer during a sale, is often determined by the manufacturer and pre-negotiated with retailers.

Retailers have leeway to offer lower prices in physical stores, but they must refrain from reducing rates for the same product when promoting online or in ads.

Consumer choices often pivot on price. Neglecting MAP and selling items at inconsistent rates can detrimentally impact your brand’s image.

While a prevalent practice, not all retailers violate MAP agreements casually. Many resort to this path out of necessity, struggling to survive within a fiercely competitive market.

Some may even sell at a loss, aiming for favorable reviews and securing the coveted ‘Buy Box’ on Amazon.

Nonetheless, the importance of vigilant retailer monitoring cannot be overstressed. Your product and brand face the consequences.

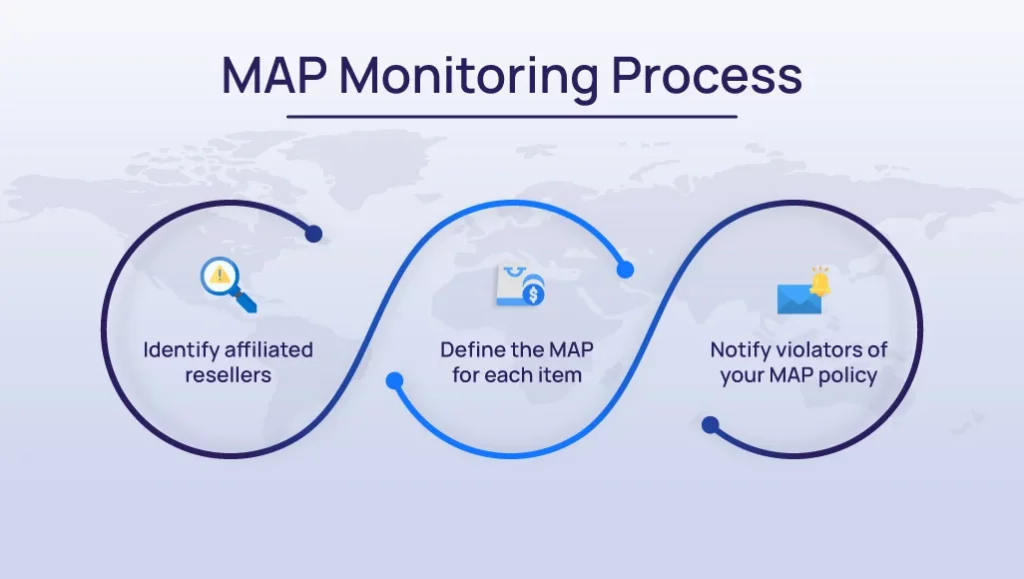

Once retailers embrace your MAP compliance pact, the subsequent pivotal phase involves establishing a sustainable MAP surveillance process. Manual attempts, encompassing countless product URLs and price comparisons, are error-prone and time-intensive. An automated approach is optimal, particularly when overseeing a wide product array.

Grepsr manages MAP akin to its competitive pricing monitoring. Upon receiving your product and retailer list for MAP adherence, we methodically scour each retailer’s site or online records for each product.

Through a comparison of the agreed MAP and their actual price, we deliver a comprehensive report detailing all MAP breaches that come in the e-commerce dataset.

E-commerce Data Extraction is a ‘simple’ but strenuous process

Web Scraping or Data Extraction is a simple and straightforward process. At least on paper. If the website you are attempting to extract data from is well-formatted, you will most likely come across only a few hiccups.

But as the volume of data rises to millions, and you monitor data across thousands of product categories, data extraction is best done outsourced.

Websites present numerous obstacles, such as Captchas and Honeypot traps, which impede your ability to access essential data for making crucial decisions.

At Grepsr, we specialize in managed e-commerce data extraction, empowering leading e-commerce websites, and retail analytics providers get access to high-priority e-commerce datasets.

If wielded properly, web scraping can save you a lot of money. We certainly have saved our clients millions.