What comes to mind when we say the word ‘real estate’?

Are you thinking of a broker dressed in a pantsuit, with shiny white teeth, walking across a manicured lawn?

Or the smell of warm cookies wafting in from an open house with a ‘For Sale’ sign planted in the grass?

For decades, buying and selling real estate relied more heavily on the art of intuition and retrospective data than the science of real-time data analytics. In recent years, the beat has shifted.

According to the National Association of Realtors, 51% of real estate transactions start online. The spotlight now shines on the commixture of tech-powered real estate marketplaces like Zillow and data scraping technologies to translate guesses into educated forecasts.

In this post, we’ll dive into how web scraping Zillow lays bare property valuations, market trend analyses, neighborhood behaviors, and strategic investments.

Why should you, as a broker, business, homebuyer, or investor, scrape real estate data?

Let’s find out.

What is Real Estate Data Analytics?

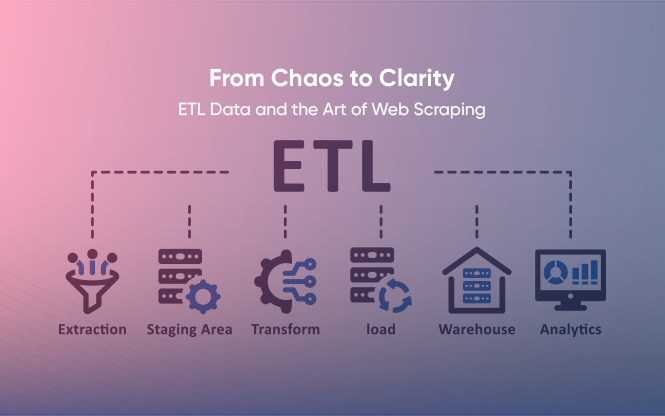

The process of real estate data analytics involves collecting, analyzing, and interpreting data from relevant sources to generate actionable insights.

This data-driven information empowers real estate professionals and prospective homebuyers to make educated decisions about property sales, purchases, rentals, and management.

Why Web Scrape Real Estate Data?

As William Penn Adair says, “Find out where the people are going and buy the land before they get there.”

But there’s a mismatch between the hyper-availability of data and the general lack of ability to harness it for quick, actionable insights. This is especially true of real estate, with Zillow alone boasting more than 100 million homes.

Imagine you’re a small real estate investor looking for your next investment in the local area. You know there are hidden gems out there — properties with immense potential that aren’t on everyone’s radar yet. Typically, you might rely on basic listings from real estate websites or the Multiple Listing Service (MLS), a service that realtors use to share information about properties. While these traditional sources can crack open a window into parsing what’s currently on the market, they don’t give you much insight into a smart investment for the future.

Here’s where you can harness the power of web scraping tools like Grepsr. They are codeless and automated data extraction algorithms that can scrape massive marketplaces like Zillow and provide you with structured information. You can find online data on recent sales, neighborhood demographic changes, and upcoming infrastructure projects, all of which can affect property value.

Web Scrape Zillow for Real Estate Success

The great thing about web scraping Zillow? For investors and researchers, it democratizes market intelligence. You can access detailed real estate data that was previously reserved for large institutional investors or expensive subscription services. Consider the playing field, leveled.

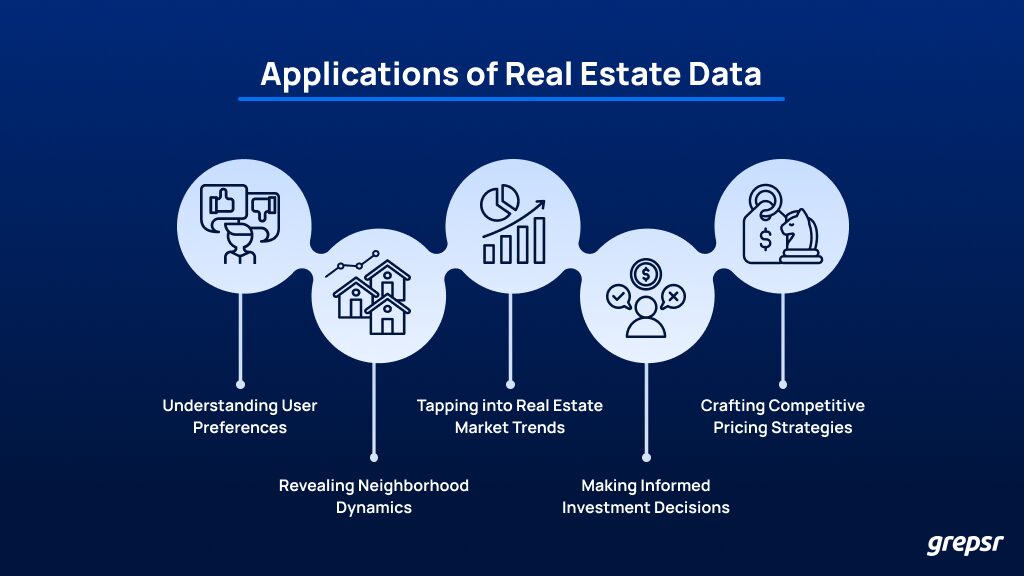

The Color Blue: Understanding User Preferences

Did you know that homes with rooms painted in shades of light blue or pale blue sell better?

It’s true.

Zillow analyzed over 32,000 photos of sold homes nationwide for its 2017 Paint Color Analysis to determine how certain paint colors affected average sale prices compared with white-walled homes.

Among all the colors studied, homes with blue-toned bathrooms commanded the highest price premium, earning $5,440 more than expected.

There’s also a link between a house’s exterior color and its sale price. The median sale price of ‘greige’ homes was $3,496 higher than comparable homes with medium brown or tan stucco exteriors. A home with a front door in shades of dark navy blue to slate gray sold for $1,514 more than one with a front door in shades of white.

Zillow’s Chief Economist explains:

“Painting walls in fresh, natural-looking shades, particularly blues and pale grays, not only make a home feel larger but are also neutral enough to help future buyers envision themselves living there.”

Svenja Gudell

This level of nuanced detail that uncovers the psychological patterns of color in homebuying would’ve been all but impossible through traditional sources of real estate data.

Green Cover: An Insight into Neighborhood Dynamics

Picture this — you’re house-hunting and two very similar homes catch your eye. One of them is on a tree-lined street with a grassy park nearby, and the other one’s built on a bare, concrete block.

Which house do you instinctively gravitate towards?

According to an interesting study, your natural inclination just might be backed by cold, hard cash.

In the journal, Urban Forestry & Urban Greening, researchers looked at how green spaces can affect home values in thousands of neighborhoods in the U.S.

An analysis of over 5,000 Zillow neighborhoods covering 44 states revealed some surprising trends. You’d think boosting home prices would be easy with more foliage and open space in a neighborhood, right? Well, hold on to your gardening gloves. The study found that on average, open space areas and NDVI were related to lower home values in Zillow neighborhoods. The overgrown, wild look is a turnoff for some buyers.

There’s a big but coming here…

BUT, the data revealed that two specific green amenities could increase your pocket income: parks and tree cover.

This study is a prime example of how web scraping Zillow can:

- Provide granular neighborhood-focused data including details like median home prices, vegetation indices, tree cover, and the presence of parks.

- Allow for reproducible, extensible, and policy-relevant insights.

- Identify unique neighborhood characteristics that are critical in driving residential desirability and asset appreciation.

Real Estate Market Trends

Think of real estate data as the raw ingredients that make up a weather prediction model.

These “raw materials” can be collected and analyzed through real estate data extraction to provide investors, realtors, and brokers with an in-depth understanding of the current real estate “climate.” This detailed insight works like a meteorologist’s Doppler radar, helping them spot patterns, fronts, and systems as they develop.

A data-driven understanding allows real estate professionals to forecast what the real estate weather will be like in the future. Are prices going to go up or down? Does the market favor buyers or sellers? What are the hottest neighborhoods?

In the same way that meteorologists predict incoming storms, this predictive capability can help them adjust their strategies and tactics before market shifts happen.

For example, in 2020, when COVID-19 hit, there were reports of a mass exodus from the cities to the suburbs. However, in a report published by Zillow, their data maintained that this narrative was overly simplistic — they analyzed listing activity, home value growth rates, page views, and rent prices.

A comparison of these metrics before and during the pandemic revealed emerging patterns that debunked the myth of widespread urban exodus.

Informed Investment Decisions

Imagine you’ve been looking for the perfect vacation rental — a stylish farmhouse in the Upstate, a sunny beach condo in Florida, or a cozy ski chalet in the Rockies.

The properties have been scouted and you’re ready to make an offer to start raking in cash as an Airbnb host. However, your holiday home dreams are suddenly on hold. The local city government tightens regulations around short-term rental properties.

As this scenario played out across several U.S. cities, researchers began looking at data from real estate powerhouses like Zillow and Airbnb. They analyzed Zillow’s transaction data and Airbnb’s rental listings to see how home-sharing platforms have fundamentally changed investing in housing.

The results of their study? The cap on home-sharing listings resulted in an 11% decline in investor home purchases.

This study shows how web scraping Zillow can give you data-driven divination into investor behavior, decision-making, and pivoting strategies in accordance with policy changes.

Competitive Pricing

An important part of running a real-estate business is monitoring the competition.

How do you stay ahead of the curve?

When you have access to up-to-the-minute pricing information, you gain a competitive edge. The web scraping method offers a powerful solution for gathering and analyzing real estate data in real-time, thereby offering you the latest numbers that are influencing the market.

Democratizing Real Estate Data with Web Scraping

Whether you’re looking for the perfect neighborhood, looking to spot up-and-coming markets, or working on housing regulations, web scraping Zillow puts Big Data at your fingertips.

From learning which colors sell more houses to how parks and trees affect property values, with web scraping, everyone has skin in the game.

We’re moving from intuition-based decisions to data-driven forecasts.

Every real estate business has its own data challenges and requirements. That’s why at Grepsr, we develop tailored data extraction strategies for our clients based on their goals. With us, you can access the full power of Zillow data without needing in-house tech skills.

The future of real estate is here — and with Grepsr leading the charge, it’s never been brighter.