The immediate fact we know about real estate is that it involves the buying and selling of houses.

But, you will be surprised to know that it is much more than that with the help of data.

Did you know that over 52% of home buyers in the US found their new home online? This is a significant increase from 37% in 2010.

Florida has the highest number of registered realtors 218,906 – taking the biggest piece of the pie from the total of 1,578,077 in the US. (National Association Of Realtors)

Surprisingly, did you know that Realtors and Real Estate Agents are NOT the same? (Who would’ve thought!)

Realtors are real estate professionals who are members of the National Association of Realtors (NAR) and are bound to follow its code of ethics.

Whereas, a real estate agent is a licensed professional who assists with property transactions but may or may not be a member of the NAR. If they’re not, they don’t have to commit to NAR’s ethical standards.

In simple terms, all Realtors are real estate agents but not all real estate agents are Realtors.

The multi-trillion dollar industry has hundreds of similar quirks. (Houzeo)

Today, we will explore essential real estate datasets required for informed decision-making. Insights from these datasets are crucial for professionals in or related to the real estate sector.

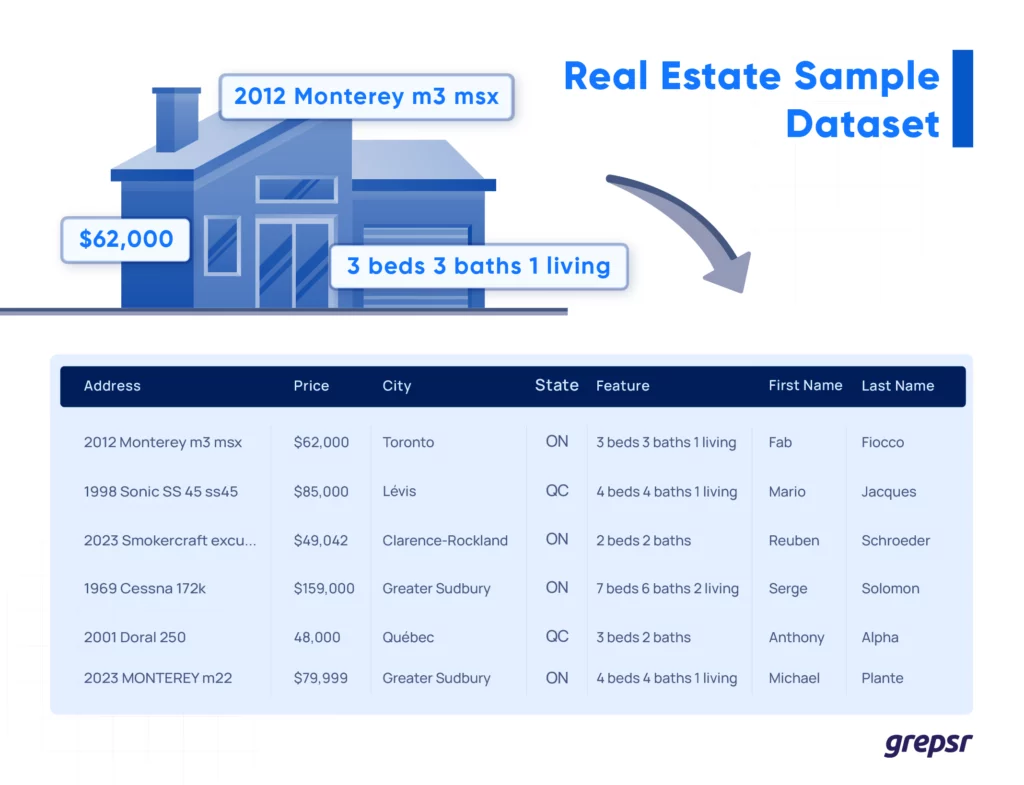

You can collect this data by web scraping where you extract the exact information you want from a publicly available source (MLS listing sites). Then, you can store the accurate data in a file, and analyze it for insights into the real estate market.

For large-scale requirements, rely on Grepsr’s prowess in web scraping to have these real estate datasets at your fingertips.

Property Listings

This includes the basic details regarding the property, such as property ID, address, and type, whether it is a single-family home, condo, multi-family unit, or apartment.

The year it was built, the total square footage area of the property, and its interior features like the number of bedrooms, bathrooms, living areas, kitchen details, etc. Also its exterior details like the garage, swimming pool, etc.

You can easily extract all the information from these data points by web scraping. Once the crawler is set, you can automate the regular data extraction without running into any obstacles. Our expertise bypasses the CAPTCHA, IP Blocking, Rate Limiting, and other anti-bot measures seamlessly, without disrupting the data-collection process.

Pricing Data

The next is the pricing dataset which includes the property’s listing price. It is the initial price set by the seller when the property is put on the market.

Information regarding the price per square foot is also extracted from the listing if it is mentioned. One can even collect price history data from the property’s previous listing prices, reductions, and increases.

Additionally, you can assess how long the property has been listed, or its days on the market. From a leading real estate online platform like Zillow, you can extract the property’s estimated market value (Zestimate), which includes the lowest range and the highest range of the market estimated value.

Sales and Transaction Data

In the sales and transaction real estate dataset, you can collect the final sale price of the property that Zillow provides for recently sold homes along with their dates. This assists real estate professionals in determining comparable market analysis (CMAs). It also helps sellers to set appropriate listing prices, and buyers make informed decisions.

Similarly, it also includes previous sales history meaning all former transactions of the property with its selling price and date. This historical sales data is useful as an indicator of property appreciation or depreciation over time.

It is essential to gain insights into the long-term market trends. Henceforth, professionals can utilize transaction data to confirm the legitimacy of ownership of the property and prevent any potential legal repercussions.

Property Tax Data

The publicly available property tax data includes the tax rate, annual property tax amount, tax assessment value, assessment year, historical tax information, and homeowner’s association fee (HOA) if applicable.

These are critical information that helps real estate professionals estimate the ongoing costs associated with the property. This eventually helps both buyers and sellers evaluate its affordability and long-term expenses.

The historical tax data provides insights into how property taxes have evolved over time which indicates trends in property value appreciation, depreciation, and possible future tax liabilities.

Similarly, you can collect the tax jurisdictions information which specifies the governmental authority (city, county, school district, etc) responsible for setting and collecting property taxes.

Also, data extraction services can help you scrape information about the delinquencies and liens of the property. They are there due to unpaid property taxes and are highlighted in the property listing. This is useful in assessing and ensuring that there are no outstanding debts or legal hindrances that could affect a transaction.

Rental Market Data

The rental market is an integral part of the real estate world. Did you know that rental prices in the US have surged 29.4% since the beginning of the pandemic? Over these last four years, there has been an annual increase of 7% and nearly two-thirds of this boom occurred in 2021 alone.

One of the most saught-after real estate datasets is rental market data. You can extract rental rates, trends, and lease terms from public platforms like Zillow and Craigslist for rental market analysis.

By extracting the Point of Interest data (POI) of a region, you can analyze the average rental rates of the properties and set appropriate prices that are competitive and profitable. Additionally, investors can identify areas with high demand and strong income potential to guide lucrative investment decisions in the real estate market.

By analyzing historical data and investing in proactive data analytics, you can forecast future rental demand, identify emerging neighborhoods that are on the rise, and optimize your property portfolio.

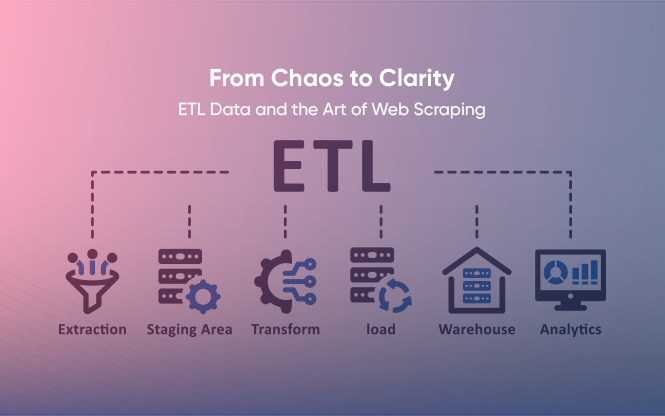

Related to the topic

Buyer & Seller Agent Information

A buyer agent is the real estate agent who represents the buyer’s interest in a transaction. They help their client find a property that meets their needs and preferences at the best price possible.

A seller agent on the other hand (also known as a listing agent) represents the interests of the seller in a property transaction. Their goal is to help the client sell their property at the highest best possible price within a short time.

Traditionally, the seller paid a commission to their listing agent, who would then split it with the buyer’s agent. This meant the seller’s payment to the buyer’s agent was an incentive to show the property to potential buyers.

However, recent changes by the National Association of Realtors (NAR) have made the buyer’s agent commission negotiable. Now, buyers can see the commission offered to their agent on the MLS listing and negotiate the compensation. Buyers may also be required to pay their agents directly.

Real estate platforms often provide details about the buyer and seller agents involved in a property transaction.

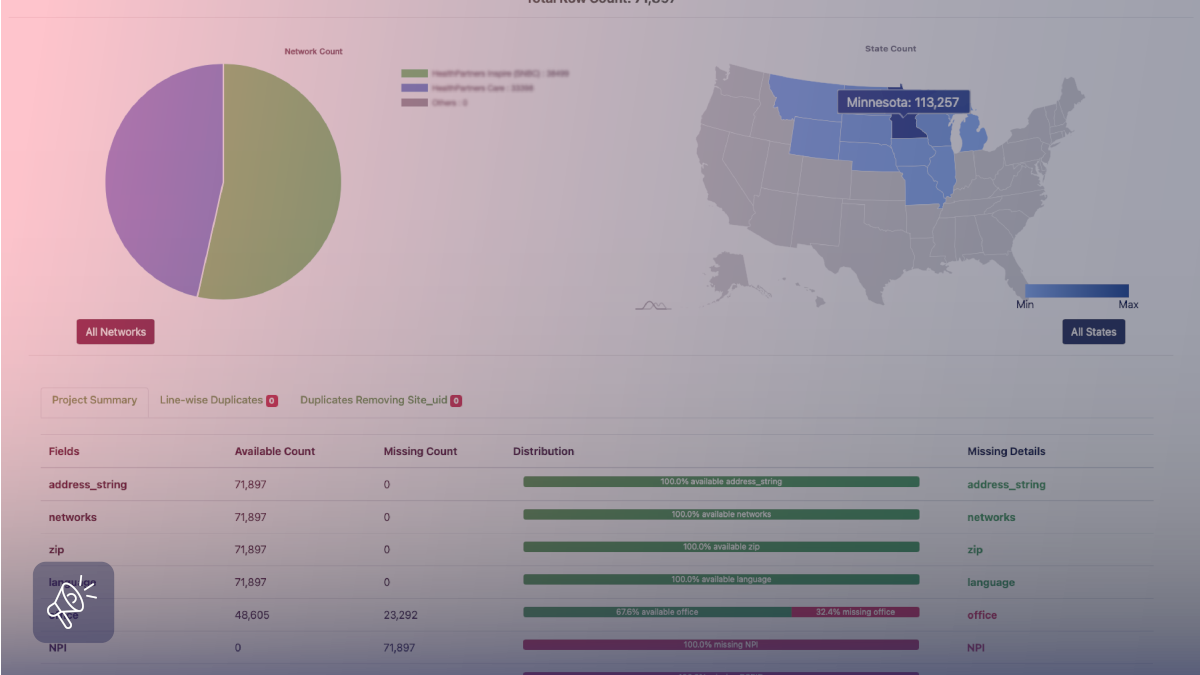

With Grepsr, you can collect both agents’ details, such as their full name, phone number, email address, and office address, if available.

You can even get For Sale by Owner (FSBO) information, the agent’s brokerage information like the brokerage name, contact details, and its website URL.

Not only do you get their personal information but you can also extract agent ratings and reviews from past clients. With that, you can have a detailed understanding of the client’s experience working with the particular agent and evaluate the quality of their service.

Therefore, give a shot to Grepsr’s Zillow scraper for detailed agent information among top real estate datasets.

End Note

To conclude the article, here are the key takeaways. The top real estate datasets you can collect by web scraping are:

- Property Listings: Key details like property ID, address, type, size, and features. Essential for property identification and comparison.

- Pricing Data: Information on listing prices, price history, and estimated values. Crucial for market analysis and price setting.

- Sales and Transaction Data: Includes final sale prices and sales history. Helps in assessing market trends and property valuation.

- Property Tax Data: Covers tax rates, assessment values, and historical taxes. Useful for estimating costs and financial planning.

- Rental Market Data: Contains rental rates, trends, and lease terms. Valuable for investment decisions and rental pricing strategies.

- Agent Information: Details about buyer and seller agents, including contact info and reviews. Important for choosing the right real estate professionals.

Don’t miss out on real estate market opportunities, leverage Grepsr’s web scraping service today!